Tax day is just around the corner. If you plan to print at home this year, we have some simple tips to ease your printing experience. Need to print out a particular tax form? A list of popular forms are available on the IRS website that you can fill out electronically and print for free, but you’ll need to install Adobe® Acrobat to fill them out online. Once you have everything prepped, here are some tips for home printing during tax season:

Make Sure Your Printer is in Good Working Order

Before you start printing your tax documents, make sure your printer is in good working order and has enough ink or toner. It’s also a good idea to run a test print to make sure everything is working properly.

(If you don’t have one yet) Choose the Right Printer

The right printer can save you a lot on printing costs. Inkjet printers are ideal for home users looking to print the occasional document or high quality photo. Laser printers are often found in offices and are great for high volume document printing. A laser printer seems like an obvious choice during tax season but if you are just filing for yourself or choose to file electronically, your print volume might be light and all that extra power may be unnecessary. The perfect printer all boils down to the user and their printing needs. If you are not sure your current printer is the right fit, check out our article:

Inkjet vs Laser: Which Printer Is Right For You?

Choose the Right Printer Cartridges

Most printers offer two or three choices when it comes to printer cartridges. Standard yield cartridges are the least expensive of the three, but they also run out faster since they contain the smallest volume of ink. High yield or XL printer cartridges are generally a better value in the long term as they offer more prints per cartridge at just a slightly higher price point. Some printers offer XXL or extra high yield cartridges as well, which are a game changer for high volume print jobs. To demonstrate, let’s look at three toner cartridges that are compatible with the Brother® HL-L6200DW laser printer:

| Cartridge Name | Page Yield | Original Brother Cost* | LD-Brand Cost |

|---|---|---|---|

| Brother TN820 Black Toner | 3,000 Pages | $70.99 | $22.99 |

| Brother TN850 High Yield Black Toner | 8,000 Pages | $115.49 | $27.99 |

| Brother TN880 Extra High Yield Black Toner | 12,000 Pages | $132.99 | $29.99 |

As you can see with the Brother cartridges, print volume varies considerably depending on what cartridges you use, so be sure to check the cartridge page yield before committing to a particular cartridge.

Page yield is the average number of prints customers will get from a cartridge, and is based on 5% page coverage. Even printers with identical price points and features may have very different page yields and cartridges for a very different price. Knowing roughly how many pages you print each month should give you a good idea on what size cartridge best suits your needs. Customers that print infrequently are probably fine sticking with a standard yield cartridge. Regular printer users should definitely consider high yield cartridges to get the most cost savings.

Compatible cartridges from LD Products can save you even more money. LD brand compatible cartridges offer the same print quality and page yield as the original brand at a fraction of the price!

Print Multiple Copies

It’s always a good idea to print multiple copies of your tax documents, in case you need to send them to different places or make corrections.

Use High-Quality Paper:

It’s important to use high-quality paper when printing your tax documents to ensure that they are legible and professional-looking.

Keep a Backup

It’s always a good idea to keep a backup of your tax documents, in case the original copies get lost or damaged. You can save a digital copy on a flash drive or cloud storage.

Check for Errors and Preview Before You Print

Before submitting your tax return, double-check all of your numbers and make sure that everything is accurate. Mistakes can delay your refund or even result in an audit. Don’t forget to hit “print preview” on your browser to confirm pages are formatted properly before sending your documents to the printer. Not only will you avoid wasting ink and paper, you’ll get another chance to double check that everything is filled out accurately too.

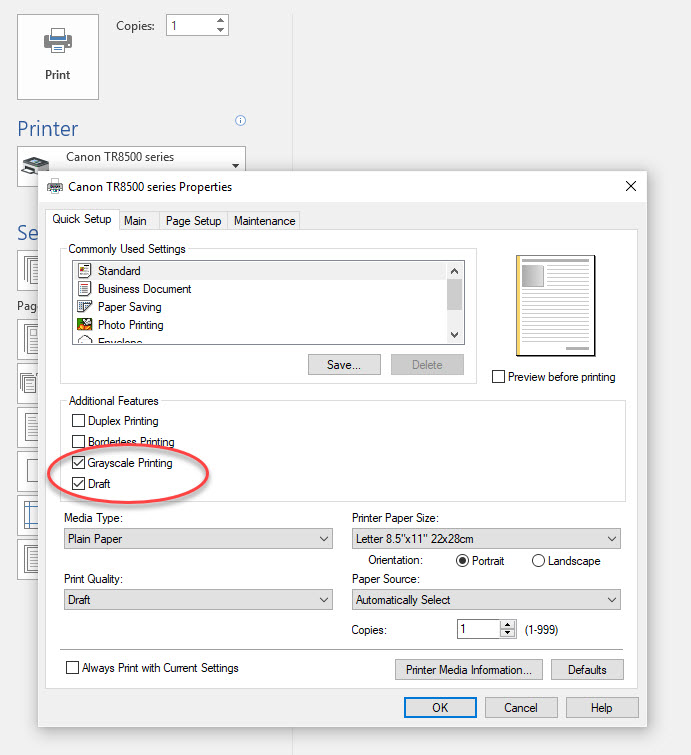

Print in Grayscale or Black and White

Tax documents can be long and complex, printing in black and white can save on ink costs. Print with just your black printer cartridge by adjusting your printer settings to “gray scale” or “black ink only” and save the color ink for family photos. Most printers have a black ink setting under the “Printer Properties” menu. You may need to consult your printer’s user guide for specific instructions. You can easily find a free PDF copy of your printer manual on the printer manufacturer’s website.

Consider Draft Mode and Duplex Printing

Draft mode uses up to 50% less ink and actually prints faster than regular mode, making it perfect for any extra pages you don’t plan to include with your file. Like gray scale printing, you can usually find draft mode under the “Printer Properties” menu, but check your printer manual to be sure. If your printer has duplex printing capability, use it to save on paper and reduce the amount of paper waste and most printers can do it automatically.

By following these tips, you can help ensure that your tax documents are printed correctly and efficiently, and that you can get your taxes done on time and without any unnecessary complications. Have any questions about the tips posted here, or a specific question about your printer? Drop us a line in the comments, we’d be happy to help.

*Savings based on price comparison between remanufactured/compatible cartridge prices on www.LDProducts.com and OEM cartridge and printer prices from Staples®. All prices effective as of June 1, 2023. OEM names are registered trademarks of their respective owners and are not affiliated with, and do not endorse LD Products. This article is intended to provide general financial education information. It does not give personalized tax, investment, legal or other business and professional advice. Consult a tax professional who can provide personal recommendations before taking any action.

Leave a Reply